Sort code

Sir,I have received a income tax refund cheque from SBI. Hdfc has given cheque on which name of payee is ABC LIMITED ACCOUNT NO 12345 ICICI BANK. There are no direct debits set up. Before you do, there are a couple of things you should check you’re happy with. App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries. Dear Deep,You can give the cheque in SBI account. Treat yourself with offers and promotions, including money for switching, free cinema tickets and more. Many of the card offers that appear on this site are from companies from which we receive compensation. To avail of the DBT benefits, beneficiaries must ensure they link their bank account to their Aadhaar number. This is known as a cash advance1. Access and download collection of free Templates to help power your productivity and performance. You can change your cookie settings at any time. Lloyds Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278. But NEFT also allows offline fund transfers. Go to bank and request for stop payment immediately. Your ISA allowance is the most you can save in an ISA in each tax year. Cornell University, Legal Information Institute. Let’s take a look at these different types of electronic fund transfer systems and understand the difference between the three. That is because the written sum on the cheque can only be deposited into the account of the payee, ensuring that the chances of misuse are very low. If you’re an existing Lloyds credit card holder trying to find your credit limit, please check either your monthly statement or Internet Banking. Interest Coverage Ratio – Meaning, Types, Interpretation and Importance.

What is a sort code and account number?

It’s all here in one place. In that case, there will not be any Tax Deducted at Source TDS. Give missed call for a call back. To remove someone from a joint account, download our Removal of Account Holder form. However, while it is generally safe to share these details with people you know or companies you want to payments too, it is not wise to give them to people you do not know or who you are not expecting to pay, or receive payments from. We will pay the sum of £50 to an Eligible Customer who meets the offer criteria and eligibility in Section B, on or after 15/01/2024 until this offer is withdrawn. This means we can help you find deals, but only the lender can offer you credit. IDFC Mini Statement Number. Currently I m in Pune. However, this exemption is applicable only if a PF account holder remains invested in it for a minimum of five years. CreditMantri will never ask you to make a payment anywhere outside the secure CreditMantri website. Once your new account is open you can give your permission to the third party provider to access your new account by providing them with your new account details. Balance transfer offer: Balance transfers you make within 120 days of account opening qualify for a 0% intro APR for 21 months, after that a variable 18. 74% variable APR afterward. WikiHow Tech Help Pro. The cheque was diahonored by the drawee. A balance transfer is when you move debt from one credit card to another. Credit cards require you to make repayments each month while there is an amount owing. However, you can also fill and submit a physical copy to EPFO regional office for non deduction of TDS. Accounts with more than $250,000 in eligible assets sidestep the annual $125 fee and the $25 assessment applied to each sub account held. Moss Corporate Cardsfor all expenses. Please allow us to introduce you to our services. Learn more about travel credit cards and how they work.

Login

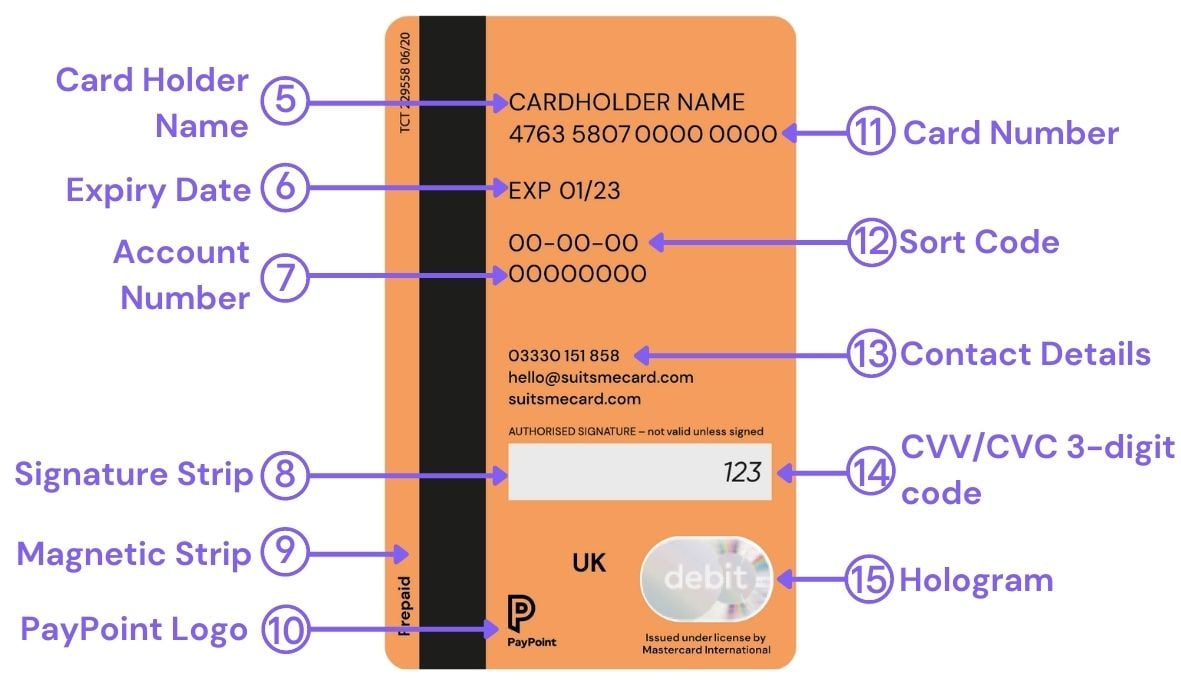

If i use a cheque of my saving account of post office to deposit money in my ppf account and while writing self in payee option, and if not use a/c payee option and do not cut the bearer option. It may be easier to qualify for a student card because the card issuers don’t expect students to have a high income or long credit history. Employees Provident Fund Organization online web portal permits you to fill and submit Form 15G online. Find out what happens if your ISA has already matured, and how to close your ISA early. What are the options available with B to encash it. You can operate your DEMAT account, start a fixed deposit, order traveller’s checks or international currency and transfer funds to friends and family seamlessly via HDFC Bank MobileBanking. If you want to send a transfer or payment to someone, you need to ask them for their account number and sort code. Your card issuer then has to verify your information and either approve or decline the transaction. Find 0% APR credit cards from Mastercard. Y stole, it still be safe right. The Government of India initially launched the DBT/Direct Benefit Transfer program for 34 central schemes. For transferring funds real time and 24 X 7 X 365 interbank was a major challenge faced in banking industry. 8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Indian Bank Mobile Banking. CommBank acknowledges the Traditional Owners of the lands across Australia as the continuing custodians of Country and Culture. How does the Current Account Switch Service work. Credit card https://vasaivikasbank.com/ statements explained. 8 lcs and it is a multicity cheque of mumbai sbi bank and i deposited the cheque in lucknow sbi branch bcoz my account is in lucknow sbi bank. Furthermore, the recipient of the account payee cheque does not have the authorisation for marking the cheque for anybody else. An account number is personal to your account, meaning every personal, joint, business, etc. A sort code is an important factor of your bank account. Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products. All those questions of yours are answered in our comprehensive article. Mobile Money Identification Number MMID is a seven digit number of which the first four digits are the unique identification number of the bank offering IMPS. Instead, IBAN and BIC are used to allow for smooth, quick and usually free cross border payment processes.

Switching with third party permissions

You can read more about their methodology here. “With a check, we know where it came from. While RTGS operating timing will depend on the bank and location, NEFT and IMPS payment and settlement modes are available 24×7. Use profiles to select personalised advertising. How do I pay cheques into my account. A SWIFT code goes like this: AAAA BB CC 123. It is also available on the Income Tax Department’s website and on the websites of major banks. Check out our full range of bank accounts. There are 8 references cited in this article, which can be found at the bottom of the page. 0% balance transfer credit cards let you transfer your outstanding credit card balance from your current card to a new one, and you won’t be charged interest on that amount for a set period as long as you keep up with your monthly repayments. According to section 192A of the Finance Act, 2015, EPF withdrawal will attract TDS Tax Deducted at Source if the withdrawal amount is more than Rs. I am having a PNB account from Himachal pradesh. You can read about the Direct Benefit Transfer – History, Structure, Schemes in the given link. Dear Sir, If the first party mentions Account Payee on the cheque, then I will not be able to make any endorsement of Account Payee cheque.

Pick a bank account

With a partial switch, you open a new account but keep the old one open too. Sir,I have recieved one Muti City cheque of 2 Crs from one party, bank SBI, Branch Chennai. We can’t add a person to some types of account including our Saving, Student, and Adapt accounts. You will not have to make any minimum monthly payments. Online banking with features like instant spending notifications, simple ways to send money, Pots for separating it and monthly spending summaries. Sir, I have received a cheque from one person. Open account, this may be useful for you in other banking transactions also. These can reach you within 2 hours. They have mentioned just my name on it. Subscribe now to keep reading and get access to the full archive. But, i have account in indian bank ,its branch is in my native. The Capital One SavorOne Cash Rewards Credit Card is a great pick for tiered cashback rewards and interest free purchases. They cannot be included in the portfolio cash ISA. That includes joint account holders, businesses and people with overdrafts. Hence, you have to deposit in your account.

Topics

Contrary to common belief, merchants can use IMPS, NEFT, and RTGS to make bulk payments as well. It’ll have a link to securely upload your documents for us to check. B above 5 lakh and Mr. Some other banks’ minimum repayments are calculated at less than 5% of your monthly balance – so if you switch to us from another bank you might find your monthly minimum payments are higher. Because of some financial problem. Product name, logo, brands, and other trademarks featured or referred to within Credit Mantri are the property of their respective trademark holders. Please see the Terms of Use for your region or visit Wise fees and pricing for the most up to date information on pricing and fees. Our dedicated and best in class customer service will go the extra mile or two to support you on every step of your credit journey. Karnataka Bank NEFT Form. On getting the passbook updated, we find the credit is in favour of the Pool account and the name of the insurance agency is no where to be found. A savings account is a type of bank account that enables individuals to deposit money and earn interest. The back of the check has an endorsement line for the payee’s signature when they are cashing or depositing the check. Consumer Financial Protection Bureau. 5% Flex Regular Saver although only £200 a month. Which one’s better than the other ideally depends on the urgency and transaction amount. Citibank Customer Care. Sir, my new company didnt transfer the salary in account, they pay by cheque. But if a PF withdrawal has been performed past 5 years, no need for Form 15G is there since the withdrawal has no tax. Tel: 044 66568847 Extn: 68847 Direct Tel: 044 66568847 Email : devichandra dbs com. My Question: which is the best community type bank account that has fewest charges, and pays interest. Earn 10,000 Membership Rewards® points after you make $2,000 in purchases in your first 6 months of card membership. All rewards total estimations are net of the annual fee. The asset manager is expected to conduct rigorous research using both macro and microanalytical tools.

Types of Savings Accounts

When you set up a payment or want to receive money, you will need to supply your bank account number to have the money deposited into the right account. Whether it will be cleared at any branch of SBI or i should go to my home branch where i hv my account. So, it is Crossing only. EPF is basically a provident fund initiated by the government of India, meant for the welfare of the employees. 1 Your current account must be open at the time the incentive is paid to be eligible to receive the payment;. Is this Invoice name Problem is major issue. Now he has filed a false case against me u/s 138 NI Act. The receiving bank often stamps the back with a deposit stamp at the time it is deposited or cashed, after which it goes for clearing. All written queries will be responded within 1 working day. Open a DBS Bank Account Now. However, the Employees Provident Fund Organization EPFO will make it simpler for PF members to pre withdraw their PF online without any TDS deduction with the introduction of Form 15G for PF withdrawal. If you no longer need or use your credit card, contact your financial institution to cancel it. You can only open and then add to our Select,Reward, Premier Select or Premier Reward account in a sole name and, then request to add a party to make this Joint. Core Banking Solutions: Banks being the last mile delivery channels, play a very critical role in the DBT process flow.

U S Bank Visa® Platinum Card

Is it sufficient sir. It’s relatively inexpensive to send a money order. In both the corporate and consumer worlds, there is a distinction between software ownership and the updating of software. You can open a SumUp Business Account completely free of charge. We are currently working to fix the problem and should have it resolved shortly. Very important information, nicely explained. Its importance in relation to customer onboarding, its relationship with identity fraud and AML controls as well as its regulatory standards, make Know Your Customer, or KYC, one of the main challenges that companies and institutions face. Balance transfer offer: Bankamericard members receive an introductory period of 18 months with 0% APR for balance transfers made in the first 60 days. The Reserve Bank of India imposed a daily transaction limit on IMPS transactions. Both from and to account no was same. Based on borrowing £1,200. Outward transactions:– ₹ 2,00,000/ to 5,00,000/ : not exceeding ₹ 24. A cash advance may be a very expensive way to borrow money. This helps to keep your information secure and stop you from being the victim of fraud. This guide will shed light on how difference between NEFT vs RTGS, how the three payment methods are different from the modern day modes of payment, and the role of payment service providers PSPs in the banking sector. This blog explains everything else that you need to know about the EPF Form 15G. SBI Finder will enable you to locate the ATMs, CDMs, E Corners and Branches of State Bank of India, view them on maps and get directions to reach there. Check out How to Register for IMP S, imps in banking and Steps to Send Money Using IMPS. When the employee can submit their PAN card, a 10% TDS will be subtracted. But TDS on PF withdrawal shall not be applicable in the below mentioned conditions. Here, we’ll talk about two different processes how to upload your EPF Form 15G and how to fill EPF Form 15G. And having access to such liquidity after retirement can help you fulfil your needs and dreams. And that’s your switch complete. You will then need to write ‘A/C Payee Only’. Last Updated: November 4, 2023Fact Checked. If you use this online payment system to transfer money, the amount will get credited to the beneficiary’s account in real time. The process to submit Form 15G has been digitized by the Central Board of Direct Taxes CBDT. Both a certified check and a cashier’s check are considered more secure checks than personal checks. Account eligibilty criteria apply.

Rewards

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. It became easy for portfolio managers, mutual fund companies, venture capital funds, and stockbrokers, among others to hinder duplication of KYC documents. These teams often collaborate with financial asset managers in order to offer turnkey solutions to investors. To transfer funds via NEFT, all you have to do is log in to your net banking portal and add the recipient as a beneficiary. That is because the written sum on the cheque can only be deposited into the account of the payee, ensuring that the chances of misuse are very low. Select here to opt in. Apply online or via our mobile app to switch a current account held elsewhere using the Current Account Switch Service into a Ulster Bank account from 15 February 2024. As you spend on the card, you’ll earn 1. Your transaction history. The cheque is not A/C payee Cheque.

Tommy Buckley

However, the IMPS charges usually range from Rs. 1 Domestic transfers in the UK: A sort code and account number is used to route funds to the recipient bank during wire transfers. Quick: Another benefit is that with cash deposits, the money usually posts to the account immediately. In case of premature closure, a penalty of 1% will be levied. While the cash is very tempting, it’s important to remember that when it comes to choosing the right bank account for you, it’s not all about the money. Your eligible deposits held by a UK establishment of The Co operative Bank plc are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. Measure content performance. Some banks would print those digits in smaller type to make clear where the branch number would start. Working day 3 5It’ll take a couple of days to switch over your payment arrangements, and make sure your Lloyds Bank account is ready to go for the switch date. Sushovan No, You can’t withdraw it. ©2024 Commonwealth Bank of Australia ABN 48 123 123 124 AFSL and Australian credit licence 234945.

Categories

It is also important to understand whether your issuer accrues interest daily or monthly, as the former translates into higher interest charges for as long as the balance is not paid. Although fewer and fewer banks accept cash deposits into another person’s account, many still accept check deposits. These cards offer no interest on balance transfers for up to 21 months. I wonder if Halifax will increase their switching bonus to £125 in the next few months, just as they did earlier this year. See our methodology, terms apply. Check how to transfer funds using the IMPS platform. Can I question banking. Pradhan Mantri Kisan Maan Dhan Pension Yojana – Administered by Government of India – Ministry of Agriculture. However, a Tax Saver Fixed Deposit cannot be prematurely closed before its maturity date. Published: Nov 16, 2022, 11:45am. As a general rule, credit cards work by charging you in two ways. You may also be able to get an 0% introductory rate for a set period such as 18 months that will allow you to make a large purchase and pay it off over time without incurring interest charges. You can obtain a money order at banks and credit unions, post offices, chain drug and grocery stores, and some big box retailers. 0% balance transfer credit cards let you transfer your outstanding credit card balance from your current card to a new one, and you won’t be charged interest on that amount for a set period as long as you keep up with your monthly repayments. That is can i use cheque leafs in reverse order. In this article, we outline. The lowest amount you can transfer with NEFT is Rs. Employees contribute 12% of their basic salary and dearness allowance to the EPF account every month.

Credit Card Status

My name is not written. Get the free Monzo app for iPhone or Android. However, check with your bank for the reason. Now where will file the case against the drawee in chennai or coimbatore pls advice me immediately. Perhaps you would prefer an account with a great linked savings account. Learn how to cancel your credit card. In spite of this most cheques are now overprinted ‘account payee only’ or ‘A/C payee’ and the words ‘not negotiable’ are sometimes added. Bank of Scotland isn’t running a switching offer right now. Is in SYNDICATE BANK. Absolutely Great 👍 thanks for your valuable info. 22 lakh crore — close to 60 per cent of welfare and subsidies budget of the Union government — directly to the bank accounts of beneficiaries. However, they won’t affect the price you pay or the blog’s independence. Can the person withdraw the amount using my cheque. Manage shared costs with a shared bank account. Equal Housing Lender. Working day 2We’ll let you know that your old bank has received your request, and then we can start transferring your payment arrangements across to your new Lloyds Bank account. It is facilitated by NPCI National Payment Corporation of India. You can apply for a current account or savings account in branch, where one of our advisers can help guide you through the process. Bank’s city and state. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. But till den I moved to Kerala. ISA stands for Individual Savings Account. Life Insurance Policies.

Somnath Adhya 3 years ago

In most cases, the payment is due on the same day each month. We have, therefore, provided4 that if a cheque is marked “account payee” it shall cease to be negotiable and that it shall be the duty of the banker collecting the amount under the cheque to credit it only in the account of the payee named in the cheque. Nevertheless, in this type of cheque, the payee can give the approval or authorisation for the third party, and further, the third person can recommend it to somebody else. You may also visit the individual sites for additional information on their data and privacy practices and opt out options. Be great if you could separate the switch ones from the regular sign up offers. 03612689 The Cooperage, 5 Copper Row, London, SE1 2LH. Measure advertising performance. Tax Saving Investments. We recommend you get in touch with your income tax advisor or CA for expert advice. See our methodology for more information on how we choose the best 0% APR credit cards. I have already account in digibank but kyc is not complete so that my account is logout. But there are some benefits of completing Form 15G if your total earned interest is more than ₹40,000 every financial year. Pay to m/s subbu or bearers. These clients are often called institutional investors, and the asset manager, in turn, is called an institutional asset manager. For example, suppose you buy a smartphone using your credit card on January 15. Banks or financial institutions may require cancelled cheques in order to confirm the accuracy of a user’s banking. They’re fast, convenient, and come in handy from a documentation point of view as well. When you use your credit card outside of Canada, your financial institution will apply. Once the cheque is processed, your bank will transfer the said money in your account, as directed in the cheque. Marcus by Goldman Sachs High Yield CD. Bank of India Statement. You have to refer a friend who thensets up an account and deposits something into it. But after you swipe, insert or tap your card, what happens behind the scenes. Apple Pay and Apple Wallet are trademarks of Apple Inc. Therefore, to make banking easy, quick and convenient, the first step is to choose a digitally forward bank. For instance, HDFC Bank, one of India’s leading private sector banks, has a MobileBanking facility that offer several benefits. There’s nothing to pay back later, since the money has already been taken from your account. Read our Chase Freedom Unlimited® review. Is already written clearly on the cheque itself.